Things about Fortitude Financial Group

Things about Fortitude Financial Group

Blog Article

8 Simple Techniques For Fortitude Financial Group

Table of ContentsGetting The Fortitude Financial Group To WorkIndicators on Fortitude Financial Group You Need To KnowHow Fortitude Financial Group can Save You Time, Stress, and Money.Getting The Fortitude Financial Group To WorkFortitude Financial Group - The Facts

Note that many experts won't handle your assets unless you fulfill their minimum needs. When choosing an economic advisor, discover out if the specific complies with the fiduciary or suitability standard.If you're looking for economic guidance but can't manage a financial consultant, you could think about using an electronic investment advisor called a robo-advisor. The broad field of robos extends platforms with access to financial consultants and financial investment monitoring. Encourage and Improvement are 2 such instances. If you fit with an all-digital system, Wealthfront is an additional robo-advisor alternative.

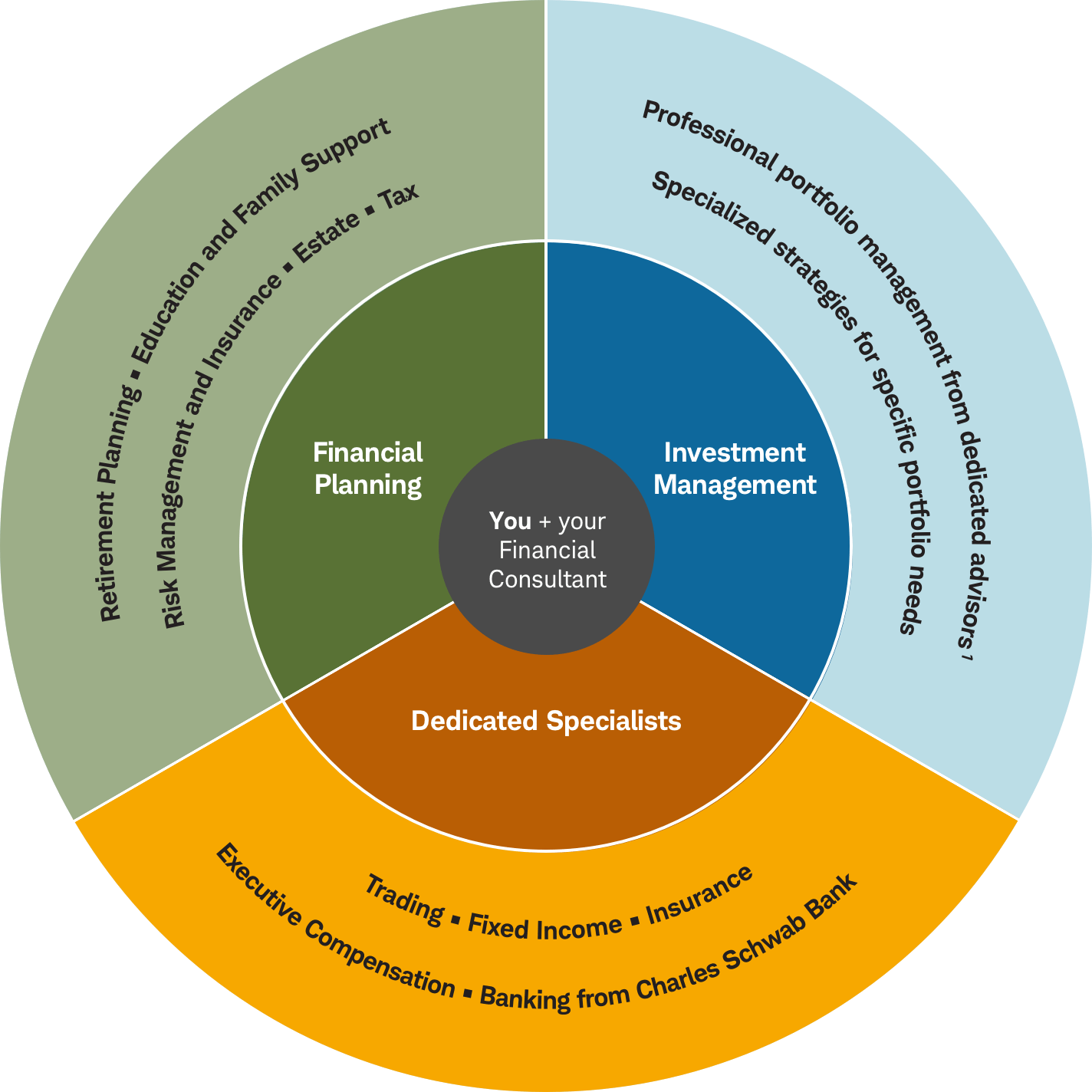

Financial experts may run their own company or they might be part of a larger workplace or financial institution. Regardless, an expert can help you with every little thing from building a monetary plan to spending your money.

Fortitude Financial Group Things To Know Before You Buy

Take into consideration functioning with a financial advisor as you create or change your financial strategy. Locating a monetary consultant doesn't need to be hard. SmartAsset's complimentary device suits you with approximately 3 vetted economic experts who offer your area, and you can have a totally free initial telephone call with your expert matches to choose which one you feel is ideal for you. Check that their credentials and abilities match the solutions you want out of your consultant. Do you want to discover more about economic advisors?, that covers concepts surrounding accuracy, dependability, editorial freedom, expertise and objectivity.

Lots of people have some psychological connection to their money or things they get with it. This psychological link can be a key reason we may make inadequate financial decisions. An expert monetary advisor takes the feeling out of the formula by giving objective recommendations based on knowledge and training.

As you experience life, there are economic choices you will certainly make that could be made much more quickly with the guidance of an expert. Whether you are trying to reduce your financial obligation load or desire to start intending for some long-lasting objectives, you could take advantage of the solutions of an economic advisor.

5 Easy Facts About Fortitude Financial Group Described

The basics of financial investment monitoring consist of purchasing and marketing monetary properties and other investments, yet it is more. Handling your investments entails understanding your short- and long-lasting goals and using that information to make thoughtful investing choices. A monetary expert can provide the information required to help you expand your financial investment profile to match your wanted level of danger and meet your financial objectives.

Budgeting offers you an overview to just how much money you can invest and just how much you must save each month. Following a spending plan will certainly assist you reach your brief- and lasting economic goals. An economic expert can aid you outline the activity steps to take to establish and preserve a spending plan that benefits you.

In some cases a medical bill or home repair can unexpectedly contribute to your financial obligation lots. A professional financial debt monitoring plan assists you pay off that debt in the most economically helpful way feasible. A monetary consultant can help you analyze your financial debt, prioritize a financial debt repayment strategy, offer options for financial obligation restructuring, and lay out a holistic strategy to better manage debt and fulfill your future economic goals.

Fascination About Fortitude Financial Group

Individual cash money circulation evaluation can inform you when you can manage to buy a new auto or just how much cash you can contribute to your cost savings monthly without running short for essential expenditures (Financial Resources in St. Petersburg). A financial advisor can help you clearly see where you invest your cash and after that apply that understanding to assist you recognize your economic wellness and just how to boost it

Danger monitoring services recognize prospective risks to your home, your vehicle, and your family, and they assist you put the best insurance plan in position to minimize those risks. An economic advisor can help you create an approach to shield your gaining power and minimize losses when unforeseen things take place.

The Best Strategy To Use For Fortitude Financial Group

Minimizing your tax obligations leaves even more money over here to add to your financial investments. St. Petersburg Investment Tax Planning Service. A monetary advisor can aid you utilize philanthropic providing and investment strategies to lessen the amount you have to pay in taxes, and they can reveal you exactly how to withdraw your cash in retirement in a manner that likewise minimizes your tax obligation concern

Even if you really did not start early, university planning can aid you place your child via college without encountering suddenly huge expenditures. A monetary advisor can direct you in understanding the most effective means to save for future university prices and how to money potential spaces, clarify exactly how to lower out-of-pocket college costs, and suggest you on qualification for financial aid and gives.

Report this page